About Enroyd.com

The era of cryptocurrency has just begun and important financial changes are ahead of us.

Investing in any kind of asset is difficult and time-consuming, but it can pay off in the long run. As cryptocurrencies are new quite, many people don’t know how and when to buy crypto. At Enroyd we provide with several techniques and data that is used by professional investors:

- Machine learning predictions

- Market sentiment analysis (machine learning based)

- Market correlations

- Market adjusted prices

- Technical indicators

All this information is freely available at Enroyd!

Technical Analysis (TA)

Technical analysis (TA) refers to several techniques that can be used to study the opportunities in a market and determine the best moment to enter, exit and, in general, manage our positions.

There are countless indicators, (supposedly) recognizable patterns, techniques and trading systems. So it is important is to know at least a few tools that complement each other well and learn how you might use them thoroughly. The upward and downward movements you can see in the price charts reflect fluctuations between supply and demand. Professional analysts often examine these rising and falling figures to identify possible trends and thus predict or estimate possible future market movements.

You probably shouldn’t pretend to learn all possible technical indicators at once. After all they’re only additional tools of your investment strategy, but learning some basic indicators could give you an edge sometimes. Quality is more important than quantity.

Technical Analysis is not an oracle: it has failed many times, it still fails and it’ll fail in the future. TA can give you a hint about when you might want to buy a cryptocoin or a stock, but it won’t tell you the future and it doesn’t guarantee profits nor any (positive) returns. Keep in mind that you always need to do your own due diligence: check whether your potential investments have any fundamental value – this is know as “Fundamental Analysis”.

On Enroyd we update all technical indicators six times per day (every four hours).

Please check these two Wikipedia articles if you want more information:

https://en.wikipedia.org/wiki/Technical_analysis

https://en.wikipedia.org/wiki/Fundamental_analysis

Simple Moving Average (SMA)

Moving averages are one of the indicators most commonly used in technical analysis and show the average price with respect to a defined period of time. The term mobile is used because they reflect the latest average price while at the same time remaining linked to the same measure of time throughout the series.

The simple moving average (SMA) is calculated by adding a certain amount of prices for a specific number of time periods, dividing this result by the number of time periods. The result obtained is the average price in that period of time. Simple moving averages use the same weighting for all prices (i.e. we assign the same “importance” to all the prices) and are calculated using the following formula:

SMA = SUM(closing prices) / n

,where n is the number of periods (typically 12 or 26 periods like in “SMA12” or “SMA26”).

For more information please refer to:

https://en.wikipedia.org/wiki/Moving_average

Exponential Moving Average (EMA)

The exponential moving average (EMA), just like the SMA, provides a “smoother” estimate of the average price for a specific number of time periods.. The difference between the two moving averages lies in the fact that the calculation of the EMA gives more importance to the more recent time periods, i. e. it is a weighted average in which not all data have the same weight.

The present value of the EMA takes into account the previous EMA value and the current price of the analyzed coin, which means that the most recent prices have a greater weight in the final price. This also means that EMA reacts more quickly to recent and sudden changes in the price evolution, but it also mitigates the impact of potential price peaks (“pump ‘n dumps”) by considering the prices of previous time periods.

Please refer to Wikipedia for more information:

https://en.wikipedia.org/wiki/Moving_average#Exponential_moving_average

Average True Range (ATR)

The ATR indicator (Average True Range) is an indicator that tries to measure price volatility. The ATR helps you estimate how much the price of a coin might go up or down per day.

The most typical period for calculating the ATR is 14, be it days, hours or minutes. The ATR is supposed to represent the “true range”. If we wanted to calculated the ATR on a daily basis the true range would the largest value among the following values:

- Today’s maximum price minus today’s minimum

- Today’s maximum price minus yesterday’s close

- Yesterday’s closing price minus today’s minimum

As a volatility indicator, such as the Bollinger Bands, the ATR does not predict the direction or duration of a trend, but rather measures activity and market volatility.

High ATR values indicate high activity in the market and, therefore, high volatility. Very high values occur as a result of a large rise or decrease in prices.

Low ATR values indicate low activity and, therefore, low volatility.

Long-term low ATR values could indicate price consolidation and may be the starting point or continuation of a trend.

Relative Strength Index (RSI)

The RSI (Relative Strength Index) is an indicator that tries to measure the strength of supply and demand at all times. The RSI is expressed as a percentage, i. e. it is an oscillator that moves between zero (zero percent) and one hundred (hundred percent), with fifty (fifty percent) being the neutral zone.

When the RSI moves away from the central or neutral zone and approaches the upper limit (hundred percent) it indicates that the forces exerted by demand are greater than those exerted by supply, and when the RSI is close to the upper limit of one hundred percent, the demand might be disproportionate in relation to the supply. When this situation occurs, the stock is said to be overbought and it could be a sell signal. On the other hand, if the RSI approached the lower limit (zero percent) the coin could be oversold, which could be interpreted as a buying signal.

When the RSI is around fifty, the demand and the supply could be more or less equal.

You can find the exact formulas and much more information on Wikipedia:

https://en.wikipedia.org/wiki/Relative_strength_index

Bollinger Bands®

Bollinger Bands are part of the technical trend indicators and consist of three bands (upper, middle and lower), which vary as a function of the fluctuations of coin prices.

These three bands are the upper, lower and middle bands. The middle band is generally a simple moving average, which we discussed above. The upper and lower bands are calculated based on the price volatility around the moving average. The distance between the upper and lower bands might give us information on volatility or market activity.

The default parameters are simple moving average of 20 periods and 2 standard deviations for the calculation of the upper and lower bands.

Generally speaking, when the market is calm the upper and lower bands tend to contract, when the market is more active the two bands tend to expand.This is because the standard deviation can be interpreted as a measure of volatility: as volatility increases, the value of the standard deviation increases. Similarly, as volatility diminishes, the standard deviation will likely decrease, which should be reflected in a contraction of the upper and lower bands.

Some traders believe that the prices tend to return to the middle band, much more so in periods when the market is moving sideways.

For more information please refer to:

https://en.wikipedia.org/wiki/Bollinger_Bands

Machine Learning

Machine Learning is a scientific discipline which creates systems that learn automatically. “Learning” in this context refers to identifying patterns in millions of data points, although there is no real “machine” behind it: it’s an algorithm that analyzes the data and tries to predict future outcomes or behaviors. In this context “automatically” implies that these systems are improved autonomously over time, without human intervention.

Many activities are already taking advantage of Machine Learning. Sectors such as online shopping (haven’t you ever wondered how certain websites manage to recommend products that actually interest you?…. Ehem, Amazon, ehem….) or online advertising (which advert should be displayed and when?) or even anti-spam filters. Other examples are:

- Predicting failures in technological equipment

- Predicting which employees will leave the company next year

- Making medical pre-diagnoses based on patient symptoms and image analysis

- Self-driving cars

- Selecting potential customers based on behavior in social networks, interactions on the web…

- Detecting transaction fraud

- And last but not least: price predictions and forecasts

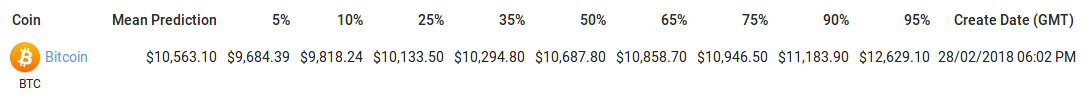

For good or for bad machine learning can help us predict the price oscillations that we see every day on Enroyd. Based on two-hourly and hourly prices and on more than 35 technical indicators we aggregate several machine learning models to predict what the cryptocurrency prices could be 24 hours from now. Is this prediction perfect? It’s not: it’s only an estimation based on past prices. The prediction intervals show the percentage of models that predict that the future price will be below the threshold in question. For example, the below means that the models estimate on February 28th 2018 at 6.02pm GMT that there is a 5% chance that the BTC price will be below 9,684.39$ 24 hours after the prediction. There is also a 25% chance the prices will be below 10,113.50$ 24 hours later, but it also means that the models estimate that there is a probability of 75% that the price will be above 10,113.50$ 24 hours after the estimate. The models also estimate that there is a 50% chance the future price will be below 10,687.80$ and that the future price will be below 12,629.10$ with a probability of 95%:

When volatility is high, the the range of these price predictions will tend to increase. Nevertheless, you shouldn’t base your investment decisions on the model’s predictions and we cannot take any responsibility if the predictions are wrong. Especially “pumps ‘n dumps” cannot be predicted by the models because normally they’re not based on any fundamentals that would justify such a sudden price increase or decrease. Our predictions are just supposed to guide you and to give you a hint as to where the “journey” might go…

On Enroyd we update the price predictions 12 times per day (every two hours).

For more information please refer to:

https://en.wikipedia.org/wiki/Machine_learning

Sentiment Analysis

Sentiment Analysis

Sentiment Analysis is the process by which we determine whether a phrase or act of speech contains an opinion, positive or negative, about a particular piece of news or article. It is a term that is closely linked to social networks but is not limited to them.

The simplest systems are limited to reading a sentence and searching for words that are registered in your dictionary as good or bad. If a good word (e. g.”great”) appears, it is a positive opinion. If a bad word (e. g. - “disappointed”) appears, it is a negative opinion.

Systems that simply detect the presence of words in the phrases analyzed are generally unable to interpret complex sentences. The complexities of the human language are such that no system today can aspire to absolute efficiency, but the most advanced sentiment analysis systems are capable of overcoming most obstacles and can provide brands with reliable information.

The sentiment scores on Enroyd.com are based on some of the most sophisticated sentiment analysis algorithms. Four times a day we scan the most important cryptocurrency forums to capture how the public opinion about the most popular cryptocoins evolves. Nevertheless, please keep in mind that you shouldn’t base your investment decisions on our sentiment score as it’s only a tool that might help you identify potentially good cryptocurrencies, but it cannot guarantee any future returns on your investment.

On Enroyd we analyze thousands of social media posts every day. Our algorithm classifies them into five categories (represented by the five smileys below, from left to right): “very positive”, “positive”, “neutral”, “negative”, “very negative”. We then aggregate these scores in order to compute the daily, weekly and monthly “Overall Feeling”. As the web is full of “coin haters” but also “coin shillers”, we came up with an algorithm that assign different weights to the different sentiment scores in order to account for potential “market manipulation”:

On Enroyd we update the sentiment scores four times per day (every six hours).

For further information please refer to:

Hutto, C.J. & Gilbert, E.E. (2014). VADER: A Parsimonious Rule-based Model for Sentiment Analysis of Social Media Text. Eighth International Conference on Weblogs and Social Media (ICWSM-14). Ann Arbor, MI, June 2014.

Correlation

Correlation

Correlation refers to the fact that the prices of some cryptocurrency pairs move in the same direction (positive correlation) or in opposite directions (negative correlation) during a certain period of time.

The range of positive correlation values is from 0 to 1.0 and from 0 to -1.0 for negative correlation.

Two cryptocurrencies will be highly correlated when they move exactly in the same direction during a given period of time, therefore their correlation factor will be close to 1. Those cryptocurrency pairs move in exactly opposite directions will have a correlation have a correlation factors that is close to -1.

Knowing the correlations between cryptocurrency pairs could potentially help you make better trading decisions: sometimes you might be able to successfully predict the price direction of a currency pair through buy or sell signals that are seen in other correlated pairs. Knowing these correlations might also prevent you from increasing your risk level: if you buy two positively correlated coins you could be doubling your risk as the price of the two coins might go at the same time.

On Enroyd we update the correlation factors once per day (at 7pm GMT). We calculate the correlation factors based on the prices of the previous 30 days.

For more information please refer to:

https://en.wikipedia.org/wiki/Pearson_correlation_coefficient

Whales

Whales

“Whales” are the investors who bought large quantities of a cryptocurrency – Bitcoin in particular – in the early stages. These can be particular investors but also hedge funds or investment funds. They are said to have a lot of market power.

For more information please refer to:

Pump ‘n Dump

Pump ‘n Dump

“Pump ‘n Dump” refers to certain manipulation tactics or manipulation schemes that aim at creating wrong buying signals by artificially pumping a coin’s price. Once the coin’s price has increased, the initiators of this pump will sell (“dump”) the holdings that they had previously accumulated.

For more information please refer to:

ICO (Initial Coin Offering)

ICO

An Initial Coin Offering (ICO) is a mean of raising funds through the issuance of digital assets exchangeable for cryptocurrencies during the start-up phase of a project. These assets, called tokens, are issued and exchanged using blockchain technology.

Initial Coin Offerings are often compared to Initial public offering (IPO), although there are important differences. The biggest difference is that an IPO allows investors to buy shares/a participation in a company, while an ICO allows investors to acquire digital tokens that normally do not represent shares in the company. These tokens represent, for example, a right to use the service that the company will develop after the ICO.

For more information please refer to: